Have you read last week’s post yet?

If you have, then you’d know just how fabulous vintage 2021 has been for growers all over Australia.

(If you haven’t… go and read it now. Go on!)

The quality of grapes was outstanding and the increased yields mean there will be plenty of 2021 wines for us to all enjoy over the coming years.

Great news… right?

Well, for most small producers, yes… it’s fantastic news. Sure, there will be a bit more healthy competition in the market. But that’s never a bad thing.

But for the bigger producers? And the small ones who normally export a fair chunk of their wine to China…??

That’s a slightly different story.

If you’re not familiar with what’s been happening with China and wine tariffs lately, here’s a quick recap…

Wine exports to China

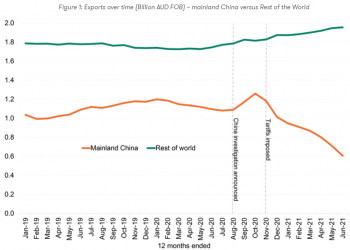

Back in November 2020, China imposed provisional tariffs (ranging from 107% to 212%) on Australian wine. In April this year, they announced that these tariffs would remain in place for five years.

Tariff: A tariff is a tax imposed by a government of a country on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. (thanks Wikipedia!)

This came as quite a blow to the Australian wine industry with China accounting for 36.7% of wine export revenue.

Gosh, 212% sounds like a lot! Why on earth would they do that??

Officially, China is saying that these high tariffs are “anti-dumping measures”. Dumping is when goods are sold below a normal value — for example, below the cost it takes to produce them — which gives producers an advantage over the foreign markets they sell to. And the Chinese are currently investigating Australia for doing exactly that.

HOWEVER…

There are apparently a whole host of “non-trade reasons” why China isn’t happy with Australia. And it’s these reasons which are being blamed for the high tariffs, including…

- Banning Huawei from the roll-out of 5G over “unfounded” national security concerns

- Foreign interference laws, “viewed as targeting China and in the absence of any evidence”

- Calls for an inquiry into the origins of the coronavirus – “siding with the US’ anti-China campaign”

- Speaking out on the South China Sea

- Speaking out on human rights allegations in Xinjiang, accusing the government of “peddling lies”

- “Thinly veiled” allegations against China on cyber attacks which Beijing says lacks evidence

- And new foreign relations laws which give the federal government power to veto state, or local government agreements with foreign governments

The numbers are in…

- wine exports declined by 10% in value to $2.56 billion and

- export volume declined by 5% in volume to 695 million litres, compared with the previous financial year

This means that (unsurprisingly) we exported less wine and the value of the wine we did export was lower than in the previous year. Considering the increased tariffs only came in halfway through the 2020-21 financial year, that’s a pretty significant reduction.

According to wine Australia, there were two key factors attributed to the decline… the tariffs and the cumulative effects of three consecutive lower vintages in 2018, 2019 and 2020. This meant there was less wine available to export.

What to do with all the wine

If China doesn’t want it, and we’ve had this amazing vintage that has produced large amounts of great quality wine, who will drink it all??!

Well, I dare say we Aussies will give it a fair go!

But we can only drink so much… and our wine industry relies on the $$ earned from exports.

Luckily, we’ve been busy making some inroads into other markets. According to the Wine Australia report, exports to the UK, Singapore, South Korea, Malaysia, Taiwan and Hong Kong have increased by a combined $240 million.

Exports to the UK were at their highest level in a decade. The value of exports increased by 23% to $472 million and volume by 16% to 269 million. This made the UK the biggest destination for exports by volume and the second by value.

Overall, excluding mainland China, exports increased by 12% in value to $1.96 billion and increased by 6% in volume to 643 million litres.

While this is great news, it’s still not enough to offset the decline in exports to mainland China.

Perhaps it’s naive and unrealistic, but I’d like too see this country much less reliant on the chinese market, not just when it comes to wine but for agricultural products in general. I’m not espousing any xenophobic attitudes, but because of their politically unpredictable and volatile nature, and their one sided attitude toward trade in general, it would be great to see the back of them, even if it means some short/medium term pain whist we consolidate our presence in other emerging markets.

I totally agree Stan! Let’s hope that at least our wine exports can find a good home elsewhere in the world.

Great blog post, Maree xo

Thanks Jill!